Buy Now, Pay Later

co-op capstone project @ a bank

Keywords: FinTech, Digital Payments, Credit, Financial Wellbeing

TEAM —

Emily Cho, Hai-Dao Le-Nguyen, Maggie Chen

TIME SCOPE —

3 months

METHODS —

Mix methods

︎ Literature Review

︎ Heuristic Evaluation

︎ SME Interview

︎ Survey (UserZoom, Maze)

︎ Experiment (UserTesting.com)

︎ Mod & Unmod Interviews

(UserTesting.com)

︎ Persona

CONTEXT

Background & Research Question

Under the context of the global COVID-19 pandemic, with restrictions on in-person activities and general economic downturns around the world, more retail purchase transactions are taking place online and people are likely facing more financial hardship. While traditional payment methods such as debit and credit cards are still the mainstream, innovative financial instruments such as Buy Now, Pay Later ( a.k.a. Point-of-Sale/POS Lending or instalment payments) are gaining momentum.

In 2019, Canadian Buy Now, Pay Later (BNPL) providers had a 13% market penetration rate. By 2022 Canadian market penetration is expected to increase to 38%. (STS Research + Insights, Buy Now Pay Later Competitive Analysis, October 2020.)

We investigated this phenomenon to better understand people’s general attitude and understandings of credit products and reveal areas of opportunity for innovation to the bank through attempting to answer the following research question:

Why do people between 18-35 years old choose to defer online payments using Buy Now, Pay Later?

Our Hypothesis

People choose to defer payments because they want to take advantage of interest-free payments and the instant gratification of buying things they may not be able to pay for in full immediately.

METHODS

We recruited participants through both panels native to the testing platforms we’ve used (e.g. UserTesting.com, UserZoom) and a recruiter with the following profile:

We also launched a pilot study of 5 unmoderated interviews on UserTesting.com to get an estimate of incidence rate (IR) and cost to recruit.

In order to gain baseline understandings of the industry landscape and current BNPL providers in the market, we reviewed secondary research materials including 20+ reports by third-party agencies, and internal competitive analysis conducted by the bank.

We also conducted preliminary heuristic evaluation of 6 of the major BNPL providers in the Canadian market: AfterPay, Flexiti, PayBright, PayPlan by RBC, QuadPay, and ShopPay.

Lastly, we interviewed a subject matter expertise within the bank who worked on a related product and gained more in-depth understanding of how the product works and the bank’s position in the market.

Participant Recruitment + Pilots

We recruited participants through both panels native to the testing platforms we’ve used (e.g. UserTesting.com, UserZoom) and a recruiter with the following profile:

- Canadians aged 18-35

- Used BNPL in the last 12 months, or open to using BNPL in the future.

We also launched a pilot study of 5 unmoderated interviews on UserTesting.com to get an estimate of incidence rate (IR) and cost to recruit.

Literature Review, Heuristic Eval, SME Interview

In order to gain baseline understandings of the industry landscape and current BNPL providers in the market, we reviewed secondary research materials including 20+ reports by third-party agencies, and internal competitive analysis conducted by the bank.

We also conducted preliminary heuristic evaluation of 6 of the major BNPL providers in the Canadian market: AfterPay, Flexiti, PayBright, PayPlan by RBC, QuadPay, and ShopPay.

Lastly, we interviewed a subject matter expertise within the bank who worked on a related product and gained more in-depth understanding of how the product works and the bank’s position in the market.

Survey

We drafted a 5-min survey with 20 questions on people’s usage of BNPL (or their interest in doing so if they’ve never used it), their preferences and habits when making online purchases, and general state of financial wellbeing.

This allowed us to collect quantitative data from a larger pool of participants, from which we can highlight aspects of BNPL to target for the following studies.

Outcome: 178 responses on Maze and UserZoom. Insights about BNPL users and non-users, synthesized from both the data aggregated by the testing platform and analysis on Excel with visual aids like graphs.

Unmoderated Interviews & Experiment

To gain more in-depth understandings of people’s attitude towards BNPL, we conducted 30-min unmoderated interviews with both BNPL users and non-users on UserTesting.com. In the same session, we also conducted a small experiment on credit and its impact on people’s perception of BNPL.

Credit is central to our understanding of why people would choose to use BNPL over traditional payment methods like credit cards, so we constructed an experiment to test whether people’s attitude towards BNPL would change based on different levels of understandings about credit associated with BNPL.

Procedure:

- 8 of the 16 participants who are BNPL users were asked about their experiences of using BNPL, and the other 8 non-users were asked about their general impressions and reasons why they didn’t use BNPL.

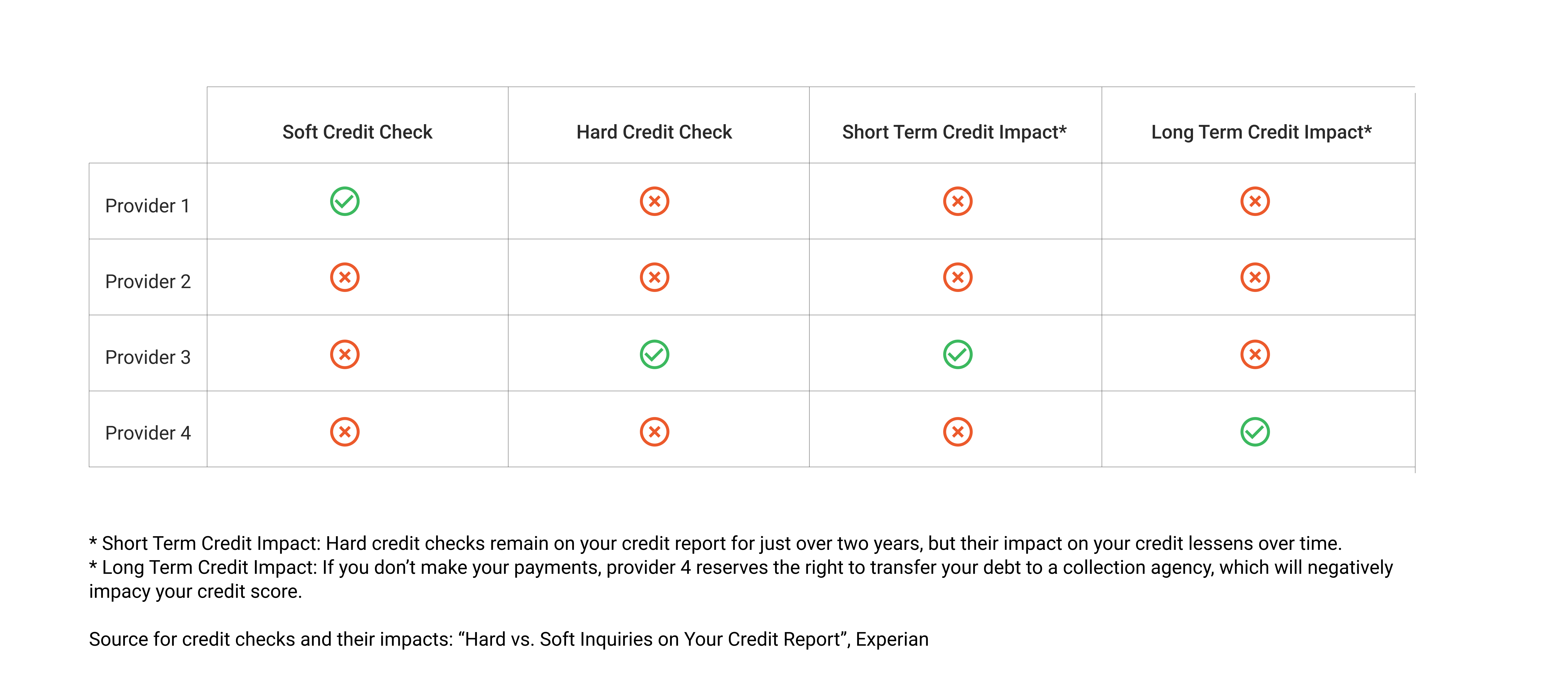

- All participants were then shown information about 4 hypothetical BNPL providers: whether they conduct credit check and if using them will have an impact on credit score.

3. All participants were asked to rank the 4 providers based on likeliness to use, as we slowly reveal more information about credit checks and credit impact (showing Fig 1 --> 2 --> 3).

Outcome: Qualitative insights and rankings about people’s attitude towards BNPL, and their preferences based on understandings about credit.

Outcome: Qualitative insights and rankings about people’s attitude towards BNPL, and their preferences based on understandings about credit.

Moderated Interviews

Lastly, we wrapped up with moderated interviews with 6 BNPL users. It helped us gain in-depth insights and personal stories about people’s experience with BNPL.

Insight 1: People tend to use BNPL for big ticket purchases.

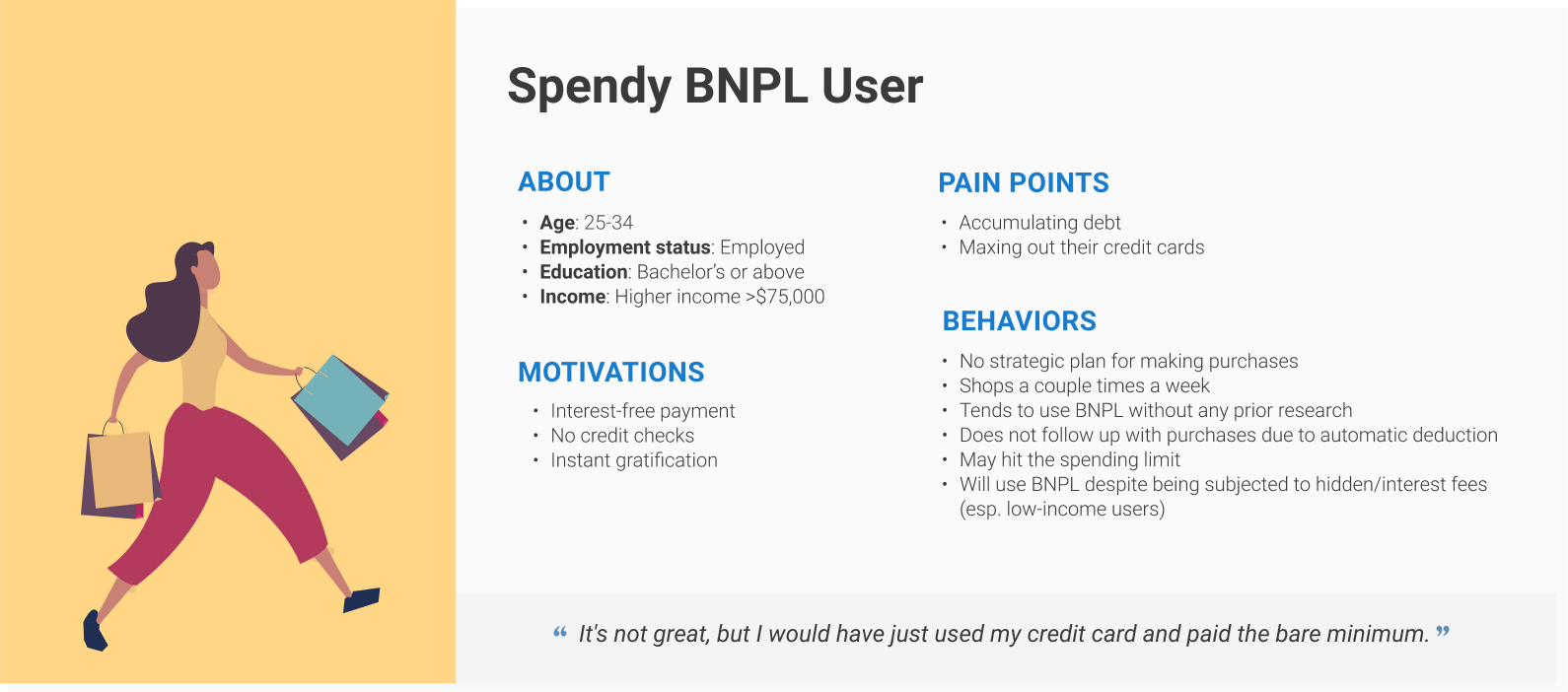

BNPL purchase values are polarized. Purchase values are generally broken into thirds around $20-120, $420-520, and $1,000+. Overall, there are more BNPL purchases over $1,000, though purchases actually differ depending on household income.

Insight 2: Though mainly determined by whether merchants provide BNPL as an option, most BNPL purchases are either furniture and appliances or clothing and accessories.

The category of goods purchased doesn’t directly match to small vs big ticket purchases. The dollar amount of the total order matters more in this case- e.g. A $600 order from Aritzia can be considered “big ticket”.

Insight 3: People use BNPL because they can’t afford to pay the full amount upfront.

This is consistent with how people tend to make bigger-ticket purchases. It is more likely that people don’t have $1,000 cash lying around, and paying for it in full might either max out their credit card or limit their spending on other items.

Insight 4: Shoppers’ trust of merchants transfer to BNPL providers at online checkouts.

For BNPL users, BNPL is seen as a more legitimate payment option depending on the merchant that offered a BNPL vendor. Exposure to BNPL through peers using it as well as repeatedly seeing it during past checkout experiences made a new payment option less scary.

Insight 5: When using BNPL, people want as little exposure to credit as possible.

Those who hadn’t used BNPL before were overwhelmingly against any kind of credit check or credit impact if they were to use BNPL.

Those who had previously used BNPL before were still hesitant about credit checks and credit impact when using BNPL. Avoiding credit checks and credit impact was a feature.

Insight 6: Based on our research, we built two personas for BNPL users: those who are spendy and those who are savvy.

Insight 7: People don’t use BNPL because they don’t need it, they don’t know enough about it, or it’s not offered as a payment option.

Non-users of BNPL thought they didn’t need to use it and didn’t know enough about this new payment option.

REFLECTION

Before & After the Research

This was a solid research capstone project, and at times it felt like a giant jam session for us as researchers. I got to try out both quantitative and qualitative research methods, and though I enjoyed the process of conducting research, going through it all made me realize the importance of the pre- and post- works involved in research - preparation and analysis. Preparation (e.g. running a pilot, writing protocol/discussion guide, set up a timeline) makes the process go more smoothly, and analysis allow us to turn what we’ve found into meaningful insights.

If I were to do a project like this again, I would spend more time on these aspects of research, especially the analysis. We were able to synthesize good insights, but it felt like there was a lot more to dig deeper into. Overall, I really enjoyed the project and am very proud of what we have achieved.

Non-users of BNPL thought they didn’t need to use it and didn’t know enough about this new payment option.

REFLECTION

Before & After the Research

This was a solid research capstone project, and at times it felt like a giant jam session for us as researchers. I got to try out both quantitative and qualitative research methods, and though I enjoyed the process of conducting research, going through it all made me realize the importance of the pre- and post- works involved in research - preparation and analysis. Preparation (e.g. running a pilot, writing protocol/discussion guide, set up a timeline) makes the process go more smoothly, and analysis allow us to turn what we’ve found into meaningful insights.

If I were to do a project like this again, I would spend more time on these aspects of research, especially the analysis. We were able to synthesize good insights, but it felt like there was a lot more to dig deeper into. Overall, I really enjoyed the project and am very proud of what we have achieved.